There are tax incentives available for IT company in Vietnam, but consultancy firms often give misleading advice about which IT operations qualify. Read on to find out which sectors are eligible and how you can secure the right tax break for your company.

A large population of young IT professionals and a growing domestic economy make Vietnam an attractive destination for start-ups and tech entrepreneurs. However, there seems to be a lack of understanding among market-entry consultancy firms about tax incentives for IT companies in Vietnam.

The truth is not all tech-based business operations are eligible and for those that are, the company must then take proper steps to prove that they meet the requirements. Metasource can provide clear advice on registering and operating an IT business in Vietnam.

Tax Incentives for IT Company in Vietnam

With the likes of Apple, Samsung and other leading technology companies increasing their operations in the country over the past few years, it is no surprise that many start-ups and entrepreneurs are seeking the same benefits the tech giants are enjoying. These land-use rights and special tax incentives for IT company in Vietnam are hugely beneficial for start-ups in the light of the low-cost, skilled workforce available in the IT sector.

Incentives for IT Company Investment in Vietnam: Eligible Business Lines

The Vietnamese government is offering opportunities for IT company to flourish. However, these businesses must be involved in the manufacturing of software products.

List of business lines eligible for investment incentives:

Pursuant to Appendix II – Decree 31/2021/ND-CP:

The manufacture of:

- Software products

- Digital products

- Key IT products

- Software services under information technology laws

- Network security products and provision of network security services under cybersecurity laws

- Products relating to technological advances within science and technology.

Software Product Manufacturing in Vietnam

An enterprise will qualify for the tax incentives if it performs at least one of the first two stages of the software production process;

- Requirements Determination

- Analysis and Design.

These two stages each cover a range of activities. For example, Requirement Determination can include one part or multiple aspects of the following operations:

- Producing or completing ideas regarding developing software products;

- Describing characteristics (requirements) of products;

- Proposing, surveying, and clarifying requirements of software products;

- Analyzing operations;

- Developing complete requirements for software products;

- Consulting about procedural adjustment;

- Consolidating requirements, approving requirements, control capacity and other factors to determine compliance of the products with the requirements.

A business must show that they perform at least one operation in either of the first two stages to establish that they are operating a software implementation service (software production).

Proving Your Eligibility for IT Sector Tax Exemptions in Vietnam

There is a myth that tax incentives are on offer to all IT services and this is not the case. Metasource has experience registering different types of IT companies in Vietnam and can give you the exact advice you need. We can have you doing business within 30 days.

You must choose the correct business line before legally establishing your company. After this, you will need to prepare proof of your operations within that business line.

To demonstrate that you satisfy the conditions for one of the business operations in the first two stages of software development, you must provide the correct document and corresponding evidence to the tax authorities upon inspection.

The tax process is not always easy to understand in Vietnam and it is much easier to make a mistake than to rectify one. Our Tax and Accounting Service can record everything in line with the government regulations. Metasource will apply the tax incentives to your business operations and demonstrate your eligibility to the tax authority.

Vietnam Tax Incentives

There are two significant benefits available to those that can successfully satisfy the above conditions:

- Value-added tax (VAT) – According to Article 4, Clause 21 of Circular 219/2013/TT-BTC on subjects not subject to VAT, computer software production and software services are not subject to VAT.

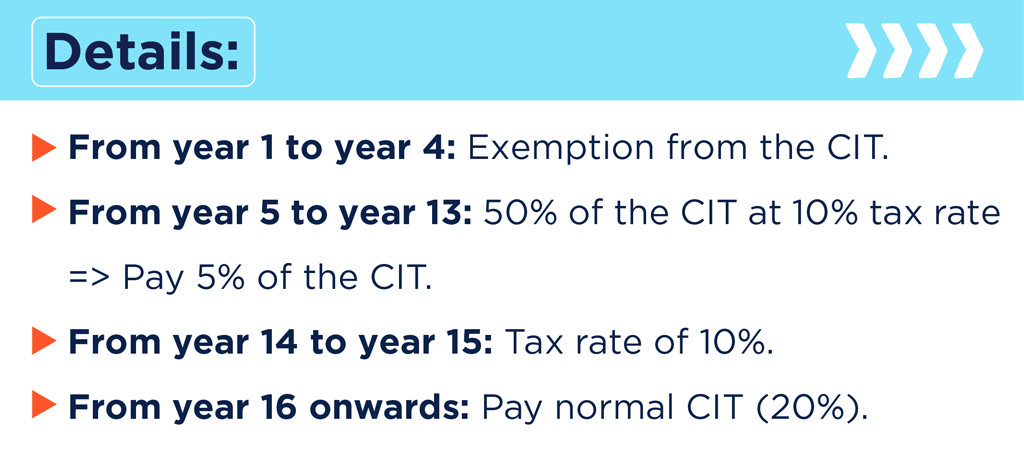

- Corporate Income Tax (CIT): Circular 78/2014/TT-BTC and Circular 96/2015/TT-BTC stipulate that software product manufacturing enterprises are entitled to the following incentives:

- The preferential tax rate of 10% for fifteen (15) years is applicable to software production.

Note: Enterprises trading in software trading are not eligible for the above CIT incentives.

According to the provisions of Circular 78/2014/TT-BTC (Article 22): Enterprises will not need to carry out any procedures to enjoy tax incentives. They shall determine the conditions for tax incentives, tax rates, tax exemptions, reduction duration, and losses cleared against taxed income before declaring their final position with the tax agency.

Registering your own IT Company in Vietnam

Being eligible for a tax break and proving it are two very different things. There are substantial benefits available within these business lines if you are correctly informed about your IT company tax position.

Metasource can provide you with the information and guidance you need to find the optimal tax position for your company. Our specialists can advise you on any further implications relating to industrial or tech zones or any questions you have regarding market entry for the IT sector in Vietnam. Avoid the confusion surrounding tax incentives for IT Companies in Vietnam and contact Metasource today.