To support Vietnam’s economic recovery, the government has introduced various incentives as of last year to help alleviate the impact of the COVID19 pandemic. The government issued Decree 52/2020/ND-CP (Decree 52) on the extension of deadlines for the tax payment and land rental fees for the 2021 tax year. Decree 52 took effect on April 19 and is similar to Decree 41 last year, which catered to businesses affected by the pandemic.

Who is eligible?

In addition to business organizations that were eligible as per Decree 41 last year, Decree 52 also lists additional businesses that are eligible for the tax extension. Some of these include:

- Publishing activities and music;

- Crude oil and natural gas;

- Manufacture of beverages, printing, copying, motorbike manufacturing, prefabricated material, chemical production;

- Drainage and water treatment;

- Radio and television, computer programming and consulting; and

- Mining activities.

How are tax payment deadlines extended?

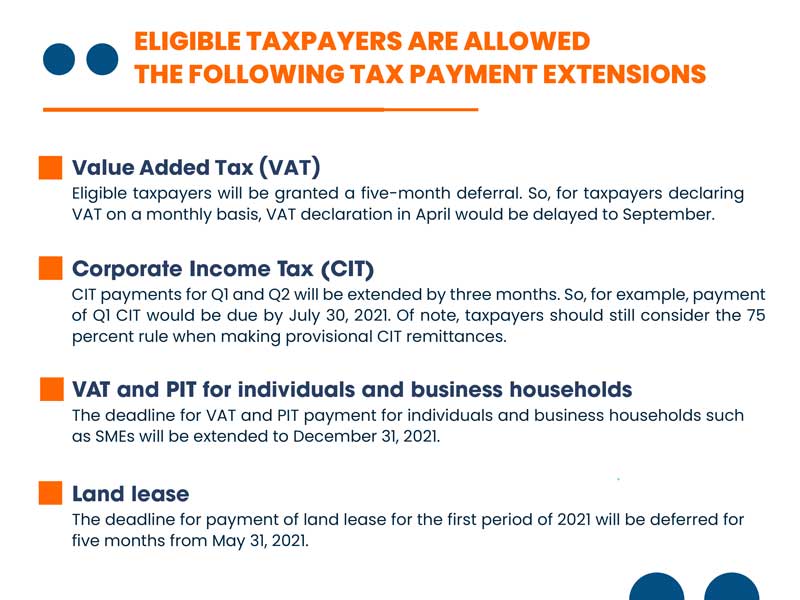

Eligible taxpayers are allowed the following tax payment extensions:

Procedures for extending tax payments

It is important to note that the tax deferral is not applied automatically, rather the eligible taxpayers must prepare and submit an application for tax and land rent deferral (either electronically, such as the form in Decree 52, or hard copy using the postal service) to the managing tax authority for their consideration.

The deadline for submitting a tax and land lease deferral application is July 30, 2021. Any submission after this date will be considered overdue and will be subject to rejection by the tax authorities.

In future tax audits, the tax authorities will carry out extensive measures in which the taxpayer must substantiate and prove their entitlement to tax incentives. If taxpayers are found to be ineligible for tax incentives, they will be subject to additional taxes and fines for false declaration as well as interest penalties for late payments.

Incentives for science and technology firms

As Vietnam becomes more selective about attracting FDI, it has prioritized hi-tech industries. Most recently in January this year, the government issued Circular No. 03/2021/TT-BTC (Circular 3) guiding the exemption or reduction of CIT for science and technology enterprises (STEs). Circular 3 came into effect on March 1, 2021.

As per Circular 3, STEs are entitled to a CIT exemption for four years, followed by a 50 percent CIT reduction for the following nine years. If no income is generated within the first three years of operation, then these will be considered from the fourth year of operations.

Who is eligible?

In order to qualify, STEs are those that have been issued with the Certificate of Science and Technology Enterprise by the relevant authority.

In addition, the turnover from goods and services generated from science and technology methods accounts for at least 30 percent of the total turnover of the enterprise.

An important factor to note is that before Circular 3, all STEs were eligible for a preferential CIT rate of 10 percent. Under Circular 3, STEs will be subject to the normal CIT rate of 20 percent. This also applies to STEs that were previously enjoying the 10 percent rate but from March 1, 2021, will be subject to the new 20 percent rate.

As per government regulations STEs are businesses that produce goods or provide services that are related to science and technology. These can range from inventions, industrial design, computer programs, livestock breeds, and plant varieties related to science and technology.

STE and other hi-tech enterprises may be eligible for other tax incentives and land rentals waivers depending on the business lines and which location they invest. For example, businesses that invest in difficult socio-economic locations may be eligible for tax incentives. Similarly, several hi-tech industrial parks such as the Da Nang hi-tech park and Saigon hi-tech park offer incentives to businesses in those industrial zones catering to hi-tech enterprises.

Securities

The Ministry of Finance (MoF) issued Circular No. 30/2021/TT-BTC on May 14 extending Circular 14 for another six months until the end of December 31, 2021. As per Circular 14, the government has reduced the prices of securities trading agencies as well as security depository services among others.

In addition, charges have been waived for IPO registration and IPO registration change services.

Seek expert assistance if challenges arise for availing incentives

Vietnam’s tax incentives, while attractive on paper, can present challenges to investors unfamiliar with the country’s legal system. Foreign investors keen on investing in Vietnam and securing investment incentives must be sure to understand the incentives that Vietnam currently offers, which will provide the best saving for them over the duration of their project, and the requirements that they will face when applying for these incentives.

Foreign investors that are new to the Vietnamese market often find the application process complex and time-consuming. Metasource familiar with Vietnam’s governmental structure can assist your company to better understand the application process.