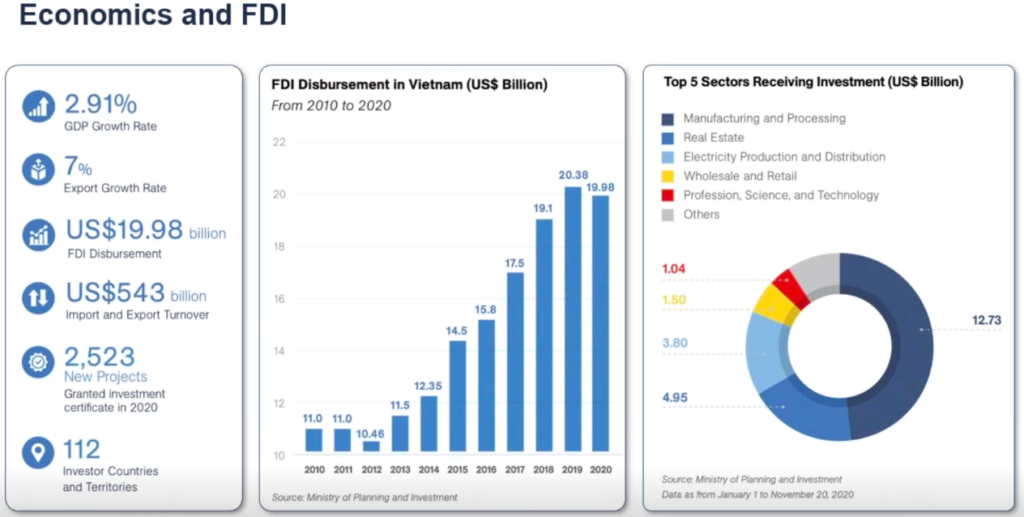

Due to Vietnam’s favorable business environment, namely its strategic position, stable political system, huge labor force and relatively open foreign direct investment environment, Vietnam has further consolidated its position as a safe and stable investment destination. Despite COVID-19, it still accounts for 2.91%.

Key to such an impressive feat was the government’s effective strategies to combat the pandemic. In addition, Vietnam has laid a concrete foundation in amending a number of key laws to recover more strongly in 2021. In addition to the free trade network with the EU, UK and RCEP countries, this helps improve the business climate. The International Monetary Fund (IMF) forecasts that Vietnam will gain 6.7 percent and will remain the only country with positive growth in five of the largest ASEAN economies this year.

Marco Förster, International Business Advisory Manager at Dezan Shira & Associates, and Phuc Duong, Senior Advisory Service Associate of Business, hosted a webinar to help foreign companies better understand key developments in the Vietnamese FDI environment and new opportunities in the country to use. Discussing key developments in the Vietnamese market in 2021, options to enter the Vietnam market, and the latest legal updates in the country.

Metasource Asia highlight key insights below:

Can you outline entry Vietnam market and some of the most important developments?

Vietnam is a quick and rising marketplace with strong financial boom and governance. In 2019, Vietnam recorded a 7 percent increase. Last year regardless of the pandemic, Vietnam recorded an increase of 2.91 percent above China’s. Besides, Vietnam is one of the few nations in the global to report a net effective increase. Besides this, exports grew at the side of FDI disbursement.

Singapore, South Korea, China, and Japan continue to be the most important traders in Vietnam. While you could see numerous investments in regions along with retail markets, buildings, and infrastructure from investors from South Korea and Japan, a thrilling factor to observe is that numerous US and EU traders use their protecting corporations in Singapore to make investments into Vietnam.

Vietnam keeps depending closely on raw inputs from China, South Korea, and ASEAN with pinnacle exports to the US, China, and the EU. In addition, pinnacle imports consist of computer systems and digital components, observed with the aid of using machinery and equipment, phones and components, textile fabrics, and plastics. A lot of those encompass raw materials.

Vietnam’s pinnacle exports encompass phones, computer systems, and electronics – that is proven with the aid of using Samsung’s factories in Ho Chi Minh City and Back Ninh contributing to developing phone exports. Samsung’s mobile exports account for greater than 50 percent of the company’s worldwide mobile phone delivery as in keeping with statistics.

What factors have affected the moving from China to Vietnam market?

There are numerous motives for transferring your production from China to Vietnam. However, I will pay attention to 4 primary ones. The first is low-fee production. While it’s authentic that Vietnam stays a lost-fee production middle with decreased exertions expenses. Vietnam is now seeking out hi-tech funding prioritizing positive hi-tech industries for growth.

The second is escaping tariffs. Vietnam is capable of staying away from obligations because of its participation in numerous free trade agreements. This trend mainly commenced to select out because of the US-China trade war and the extra push of Vietnam’s intertwining in worldwide FTAs.

The third is Vietnam’s import/export processing in the heart of ASEAN. Vietnam’s geographical area facilitates as it borders China and is in near proximity to other ASEAN countries. It is the go-to preference for local distribution in ASEAN and APAC if not in worldwide import and processing. Vietnam’s FTAs and double tax agreements are a large contributor to this trend as well.

The fourth is the exodus of overseas experts moving to Vietnam, specifically previous to the pandemic. Vietnam’s living fees are normally less expensive than China’s and are consequently reasonable. Vietnam has a pleasant environment and is extra open to tourists in general. While there are internet restrictions – social media, search engines, and messaging systems may be accessed in the country making it simpler for foreigners to stay here.

It is essential to notice that Vietnam may be a manufacturing hub but never Asia’s production hub. Clearly because of Vietnam’s size as compared to China’s. China has sixteen times the workforce as compared to Vietnam. Foreign investors have to be cautious with their expectation of control once they appear to relocate or complement their China operations.

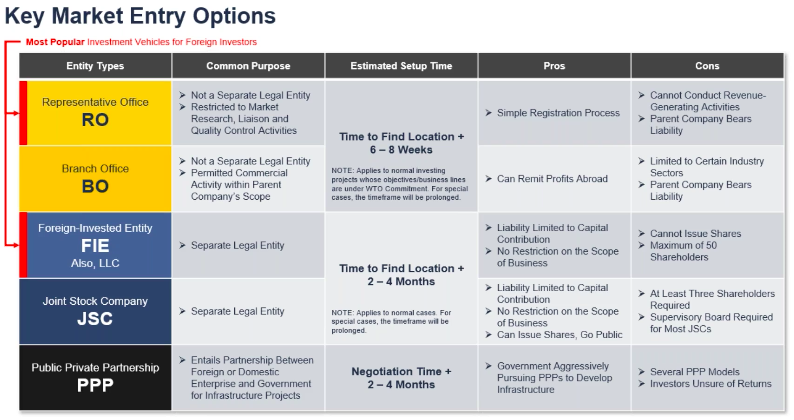

How can an investor enter Vietnam market?

There are numerous ways you may enter the Vietnam market. One of the elements that an investor has to keep in mind is location. Vietnam’s areas vary and the North, Center, and South, have precise benefits for specific industries. For example, the North is good for corporations moving from China but may also have higher labor prices. The South is the economic center of the country and extra possibilities because it has a huge consumer base. The middle is relatively much less competitive and is a low-fee destination but can be ripe for investment because of numerous government incentives in towns such as Da Nang.

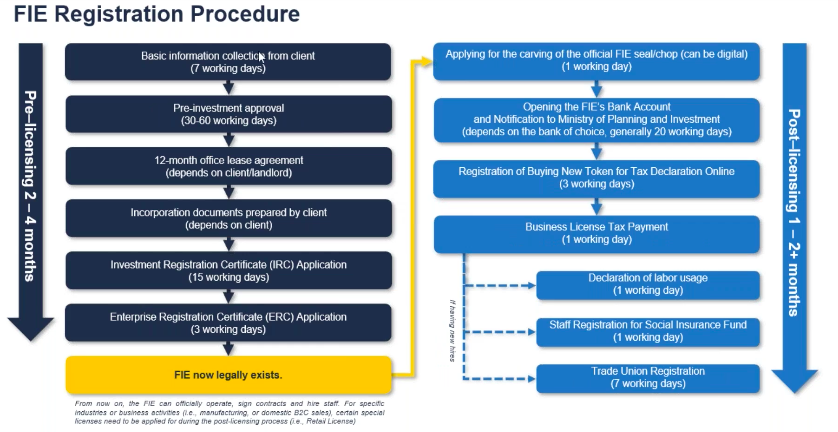

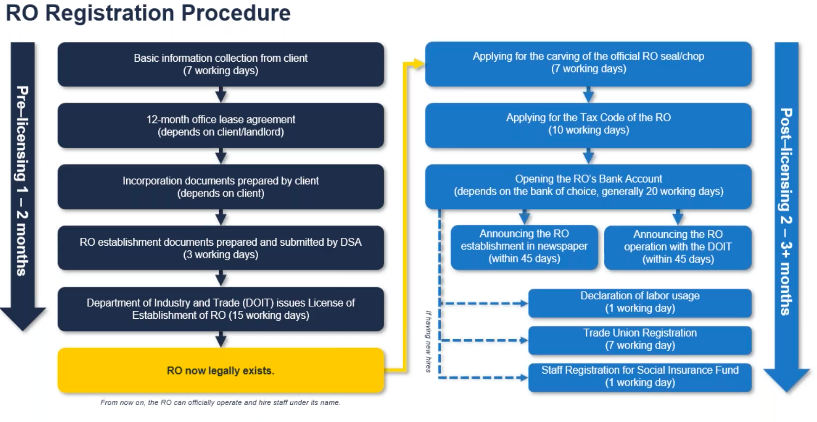

While there are numerous office systems to enter the Vietnamese market, in our enjoy the representative office (RO) and the Vietnam foreign-invested entity (FIE) are the most famous investment vehicles in Vietnam.

Are there any latest adjustments to business guidelines that an investor desires to be aware of?

The government lately passed the Law on Investment and Law on Enterprises which got here into impact in January 2021. These amended legal guidelines simplify enterprise registration techniques while also offering updates on conditional business traces.

Some adjustments consist of the removal of the seal specimen and extra safety for minority shareholders. However, an essential issue to notice is that for the primary time the Law on Investment consists of ‘negative list’. The different class is conditional enterprise lines where overseas investment is permitted but problematic to government approval for certain sectors.

The foreign ownership threshold has been reduced from 51 percent to 50 percent. This additional approach that M&A approval isn’t always required if the transaction does not result in a growth of foreign investors’ ownership ratio in the goal corporation.

Finally, is Vietnam market really ‘it’?

Depends on ‘it’. If ‘it’ way factory of the sector then no. Vietnam can’t compete with China in this sense but if ‘it’ approaches supplementing your China operations. Vietnam’s handy role with the West and East then yes. There has been a massive hype about Vietnam lately, but investors want to be aware of its boundaries as well. Bottlenecks have already emerged – and no single country and soak up China’s production. MNCs will keep diversifying operations into other parts of Asia to keep on fees and restriction of production disruption.